If you’re dosing cannabis with one of the new sublingual strips on the Canadian market, you’re part of a burgeoning trend that analysts believe is on the cusp of becoming a major consumable format.

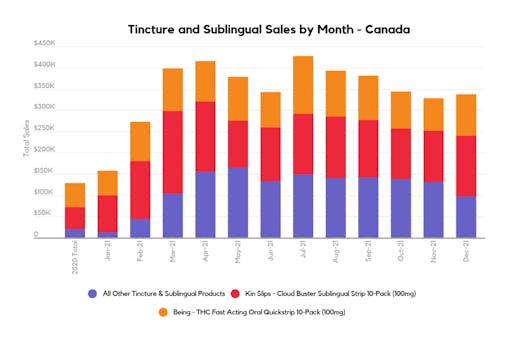

Along with tinctures (aka oil drops), sublingual products saw a massive 3000% growth in Canadian sales between 2020 and 2021 (with the necessary caveat noting these products only entered the market in 2020). While they still only represent a small portion of cannabis sales, the rapid growth points to a new consumer trend.

According to data compiled by Headset, “…it seems that Sublingual strips are driving a significant portion of growth to the Tincture and Sublingual category in Canada, with very few distinct products supplying the majority of sales.”

The report notes sales of sublingual products reached their peak in July 2021, at around $425,000 nationwide, and then sales dipped in December to just under $350,000.

Sublingual products resemble breath mint strips you would place under your tongue. Either sporting 5 mg or 10 mg of THC, these strips offer a quicker high onset of around 15 minutes, compared to around 90 minutes for edibles and beverages.

As Leafly wrote earlier, sublingual absorption is so effective because it avoids the gastrointestinal system, where gastric acids and enzymes often convert delta-9 THC into the more psychoactive form of 11-hydroxy THC.

Sublingual strips avoid that route by interacting directly with the bloodstream through that membrane underneath the tongue. It gives the consumer a purer delta-9 experience, which feels similar to smoking or vaping

Cannabis consumers want to try everything at least once

As part of the 2.0 class of cannabis products rolling out in Canada, they represent a more discreet format for Canadian cannabis consumers compared to flower and vapes.

“I’m not surprised so many people went out to buy these types of strips,” says Rachel Colic, chief strategist at Y Creative, a consultancy practice focused on brand strategy for the cannabis industry. “This is a long-awaited format, it’s novel and new and people always want to try everything once.”

She notes that the format is consumer-friendly due to how sublingual strips resemble the easily recognizable product of breath-mint strips, such as Listerine’s PocketPaks.

What is also turning heads favourably is how this market has surged in the past 18 months with only two key players in the market: Being’s THC Oral Strips, produced by Thrive Cannabis based in Simcoe, Ontario, and Kin Slips from Aleafia Health in Toronto.

Colic says the limited entrants into the market have done impressive heavy lifting in their category. “I find it remarkable that these two SKUs have been carrying all that growth and filling in the gap left by the cannabis market.”

Top selling format for medical cannabis patients

In speaking with Tricia Symmes, CEO of Aleafia Health, she says sublingual strips have become one of their top-selling products from their medical division. They have also been churning out strips for the adult-use market, and one of their big sellers is their high-CBD strips.

“It’s discreet, offers reliable dosing, and it’s become very popular for consumers new to the space,” says Symmes, noting how her licensed producer (LP) partnered with Kin State Group in California to distribute the strips to the Canadian market.

She adds Aleafia and Kin are working to bring more sublingual products to Canada in the coming year, such as ones with different flavours and CBD isolate.

But if sublingual cannabis products are poised to potentially be the next hot format, why are only two LPs in Canada producing them?

The lack of market research in this area is an obstacle, says Dessy Pavlova, project manager at CannStandard, which tracks Canadian cannabis sales. “And flower still has the allure to many consumers and LPs, and it’s still number one in market share in Canada.”