Editor’s note: Check out Leafly’s 2019 version of our Legal Jobs Count, which provides a state-by-state breakdown of the 211,000 full-time jobs the legal cannabis industry has created in America.

Read Leafly’s 2019 Legal Jobs Report

(Amy Phung/Leafly)

It’s not easy to determine how many full-time jobs are supported by America’s legal cannabis industry. But that doesn’t mean we can’t try.

As Leafly contributor Rob Reuteman reported yesterday, the federal government doesn’t allow cannabis jobs to be tallied using NAICS codes, which are the basis for most standardized employment data in the U.S., Canada, and Mexico.

There are 122,814 legal full-time cannabis jobs in America.

Documenting those jobs is more important than ever. The fate of state-legal cannabis remains uncertain as the Trump administration prepares to take office. At his Senate confirmation hearing next week, attorney general nominee Jeff Sessions will answer questions about legalization. Sessions has spoken out against legalization in the past, and many believe he may take steps to curtail the industry.

Sessions and members of the Senate Judiciary Committee should be aware of the more than 122,000 legal, hard-working, taxpaying Americans whose jobs are supported by legal cannabis. By tallying estimates for each state, we found 122,814 full-time jobs.

Behind every one of those jobs is a hard-working, taxpaying American. They’re the botanists at Medicine Man in Denver; the oil extraction technicians at Dama in Seattle; the budtenders at Farma in Portland; the mechanical engineers at Apeks Supercritical in Johnstown, Ohio; the scientists at Steep Hill Labs in Honolulu, Albuquerque, Seattle, and Portland. They’re lawyers at Harris Bricken, they’re software developers at MJ Freeway Business Solutions. They’re writers, editors, web developers, event planners, and customer support specialists here at Leafly.

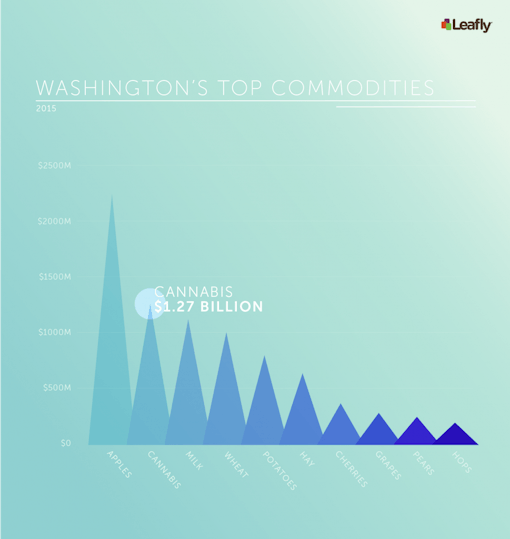

They’re also farmers. With $1.27 billion in sales in 2016, Washington state’s cannabis crop now represents the second most valuable farmed commodity in that state, behind only apples—and ahead of milk, potatoes, and wheat.

If a Sessions-led Justice Department—which includes the DEA—were to interfere with successful, regulated legalization in 29 states, the Trump administration would be directly sending American jobs across our borders. Some ancillary businesses would survive; a few might move to Canada. But thousands of safe, legal American cannabis farming, harvesting, processing, and distribution jobs would be sent across the southern border to violent, criminal Mexican cartels.

And there are a lot of legal jobs out there. It took us three months to research and count them. Here’s what we found.

Adult Use States

| State | Jobs Supported by Legal Cannabis |

|---|---|

| Colorado | 23,407 |

| Washington | 22,952 |

| Oregon | 11,295 |

| Alaska | 154 |

| Washington, D.C. | 150 |

| Total: | 57,958 |

Medical Use States

| State | Jobs Supported by Legal Cannabis |

|---|---|

| California | 43,374 |

| Michigan | 7,726 |

| Arizona | 4,681 |

| Nevada | 2,295 |

| Massachusetts | 1,283 |

| Illinois | 954 |

| New Mexico | 723 |

| Connecticut | 632 |

| Montana | 629 |

| New York State | 573 |

| Maine | 470 |

| Rhode Island | 439 |

| Maryland | 294 |

| New Jersey | 199 |

| Minnesota | 190 |

| Vermont | 143 |

| Delaware | 81 |

| Florida | 70 |

| New Hampshire | 52 |

| Hawaii | 48 |

| Pennsylvania | Not Open Yet |

| Ohio | Not Open Yet |

| Louisiana | Not Open Yet |

| North Dakota | Not Open Yet |

| Arkansas | Not Open Yet |

| Total: | 64,856 |

How We Arrived at That Estimate

Few states have reliable data on cannabis jobs. But each legal state keeps a tally of something. Some track the number of registered medical cannabis patients. Others keep tabs on licensed dispensaries, or annual sales figures. There’s usually at least one reliable number out there. Using that number, we did a little algebra. We solved for X using other known values.

Our starting points were Colorado and Arizona.

In October 2016, the Denver-based Marijuana Policy Group (MPG), a public policy consulting group that often does contract work for various state agencies, published a study of the cannabis industry’s effect on the Colorado economy. It included the most rigorous study on cannabis jobs to date. You can read the whole thing here.

The MPG study found that $996 million in Colorado cannabis sales in 2015 supported 18,005 full time equivalent (FTE) jobs. (The figure in the table above is higher because it’s based on estimated 2016 sales of $1.33 billion.)

The gold-standard study found 18,005 Colorado jobs based on $996 million in sales.

We had a long conversation with economist Adam Orens, one of the principal authors of that report. He told us how he and his colleagues came up with foundational job numbers by ground-truthing a lot of Colorado license holders. That is, they visited, called, and wrote to various business executives, asking how many people they employed.

Orens cautioned us on the use of his firm’s data. A professional economist, he said, would not transfer the Colorado assumptions and numbers to other states. “It wouldn’t be sound practice,” he said, because each state’s cannabis industry exists under different regulatory conditions. And no trade flows across state borders. When it comes to cannabis, each state is a hermetically sealed economic system.

With due respect to Orens and his MPG colleagues, we’re going to break that rule of non-transferability. It may not be the absolute best economic practice to do so. But the cannabis economy operates in an environment where incremental progress is necessary. Our numbers aren’t perfect. But they’re better than none at all. And a state-by-state good-faith effort is a far sight better than pretending, as the federal government does, that more than one hundred thousand legal full-time jobs simply don’t exist.

If 2016 sales were compared to the latest (2015) data on agricultural commodities, cannabis would be Washington state’s second most valuable crop. (Click image to enlarge.) (Amy Phung/Leafly)

Establishing Known Values

Let’s create a known value. If $996 million in sales supported 18,005 full time (FTE) jobs in Colorado, then an average of $55,333 in sales were required to support one full time job. That’s a useful number.

Arizona also gave us a couple helpful known averages. The southwestern state maintains one of the nation’s most reliable counts of patients and dispensaries. Currently there are 99 dispensaries serving about 98,000 patients. The state also tracks how much cannabis—by weight—is sold by dispensaries and posts that data monthly. Thanks to the Leafly menu app, we know that cannabis sells for about $300 an ounce in Phoenix ($280 for bottom shelf, $360 for top). That’s $4,800 per pound.

Using that information, we can calculate an average $21.6 million per month in sales in Arizona, based on 4,500 monthly pounds sold at $4,800 per pound retail. That gives us a figure of $259 million in annual sales in Arizona. Spread among 99 registered dispensaries, that means each dispensary records around $2.6 million in annual sales. That’s a helpful estimate to have when the the number of operating dispensaries is the only known data point in some states.

Here’s another known value: Arizona’s $259 million, spread among 98,000 patients, works out to about $2,643 in annual medical marijuana purchases per patient. That’s about $220 per patient per month. Which, in our personal experience, seems about right.

If we apply Colorado’s jobs-per-sales number to the sales figures in other states, and Arizona’s per-patient and per-dispensary averages, we start getting some interesting job estimates.

Below, we explain how we arrived at full-time equivalent job estimates for each of the 29 legal states plus the District of Columbia.

STATE BY STATE

ADULT-USE STATES

Colorado: 23,407

In 2015, $996 million in sales yielded 18,005 full time jobs, according to the Marijuana Policy Group’s October 2016 report. 2016 sales are on track to reach $1.33 billion. If the same sales-to-jobs metric holds, that would put Colorado at 23,407 FTE jobs.

Washington State: 22,952

Officially, Washington’s Liquor and Cannabis Board recorded $1.1 billion in cannabis sales in 2016. But that number is deceptive, because medical dispensary sales—which weren’t tallied by the state—began at an estimated $35 million per month in January and shrunk to about $15 million per month in June as each of hundreds of dispensaries shut their doors. Starting July 1, all sales—adult use and medical—went through state-licensed retail shops. We estimate that missing medical sales figure at $160 million , which brings the state’s 2016 sales total to $1.27 billion. If we use the Colorado formula ($55,333 in sales buys one FTE job), that gives us a full time job estimate of 22,952.

Oregon: 11,295

We have to figure Oregon’s sales by using the state’s only published number, which is monthly marijuana tax revenue. Oregon is now consistently averaging $7.1 million in monthly cannabis tax revenue. Prorated , that’s $85.2 million per year. Oregon has been tricky, because until recently adult-use stores collected a 17 percent tax on sales while medical dispensaries that also sell adult-use cannabis collected a 25 percent tax on sales of adult-use products. (That disparity ended on Dec. 31, 2016.)

At the 25 percent rate, that yields gross sales of $340.8 million/yr (for a medical shop selling retail).

At the 17 percent rate, that yields gross sales of $501.2 million per year (for a retail shop).

If we estimate that a quarter of adult-use sales were through medical shops, we arrive at an annual sales figure of $461 million.

From there we have to add an estimate for medical cannabis sales, which are not taxed. For that we go to the number of patients registered by the Oregon Department of Health: 68,000. Let’s subtract 10 percent to account for for patients who are registered but not purchasing. Then we’ll apply the annual patient spending average figure we got from Arizona. 62,000 patients multiplied by $2,643 annual average purchases equals $164 million.

Combine the $164 million in medical sales with $461 million from the adult-use market and we get $625 million in annual sales. Using the Colorado sales-to-jobs metric, that yields 11,295 full time jobs.

Alaska: 154

Alaska has 1,093 registered medical cannabis patients, which would normally equate to annual sales of around $2.6 million. But Alaska is a big homegrow state, so that’s got to be factored in. It’s just now starting to see some adult-use retailers open. That market is projected to generate $6 million to $12 million in sales during 2017. There are 21 cannabis farmers currently licensed by the state. We’ll estimate four FTEs per farm, so there’s 84 jobs. The state is still trying to get one lab licensed, so there’s 10 more jobs. There are about 18 retailers up and running around the state, but they’re still small operations. We’ll estimate 60 jobs for that sector. Total: 154 full time jobs. There are probably more, but we’re going to stay conservative on Alaska right now.

Washington, DC: 150

Technically legal for adult use but hamstrung by Congress, the District’s jobs remain strictly in the medical sector. Adults can possess and share cannabis legally, but nobody can buy or sell it, which means nobody can make a legal living from the adult-use market. In the medical market, there are approximately 3,500 medical marijuana patients. Subtract 10 percent for patients who don’t purchase and we’ll say 3,150 patients make up a market of around $8.3 million in annual sales. That supports around 150 full time jobs.

MEDICAL STATES

California: 43,374

Yes, California just legalized adult-use cannabis. But the first licenses for non-medical cannabis growers and retailers won’t be issued until Jan. 1, 2018, at the earliest. For at least the next 12 months, California remains a medical state. And it’s a state that continues to keep no accurate count of patients, sales, dispensaries, or weight of product sold. So we’re left with sweeping market-size estimates based on the state’s population, cultural affinity for cannabis, and one solid piece of data about the number of operating dispensaries.

The market analysts at Arcview and New Frontierestimated the state’s total medical cannabis market in 2016 at $2.7 billion. That’s three times the market size of Colorado, a state with one-sixth the population of California. On the lower end, the analysts at Marijuana Business Daily, in their 2016 Marijuana Business Factbook, estimate 875,000 patients in California and a market value of $900 million to $1.2 billion. That market value is on par with Washington state’s current market size, which strikes us as a substantial underestimate. If we take MJ Biz’s patient estimate, though, and apply Arizona’s per-patient annual spending average ($2,643), we get $2.07 billion in annual sales—a more solid, if still conservative, estimate. It’s hard to imagine Arizona patients spending more per year than California patients.

Here’s another way to crack California: In 2015, Erick Eschker, an economics professor and co-director of the Humboldt Institute for Interdisciplinary Marijuana Research at Humboldt State University, ground-truthed the number of actual operating dispensaries in California. He and his research team found 815 . At $2.6 million in average annual sales per dispensary, that’s a $2.1 billion market, which is close to the MJ Biz patient-based estimate above.

Let’s set the low estimate for California’s market value at $2.1 billion and the high at $2.7 billion. Then split the difference. Call California, in 2016, a $2.4 billion market. Using the Colorado sales-to-jobs metric, that yields 43,374 full time jobs.

Michigan: 7,726

According to the Michigan State Department of Health and Human Services, there were 182,000 medical cannabis patients registered with the state in 2015. (Michigan has a population of around 10 million people, which puts its MMJ patient per-capita rate a little lower than Arizona’s.) State MMJ cards expire every two years, and it costs $60 to apply and renew, so we can assume there aren’t many non-purchasing patients on the list. Leafly’s dispensary finder, as well as other sources, list about 190 dispensaries around the state. If patients were dispersed equally, that’s 958 patients per dispensary, or $2.5 million in annual sales per dispensary, for a total market of $475 million. Michigan is an active homegrow state, so we’ll knock 10 percent off for patients who grow their own. That leaves us a market of $427.5 million, which supports 7,726 full time jobs.

Arizona: 4,681

See our previous discussion of Arizona, above, for details on the state’s data. $259 million in medical cannabis sales in 2016 yields 4,681 full time jobs.

Nevada: 2,295

Nevada is tough to get a handle on. ArcView/New Frontier forecast $121 million in medical cannabis sales in 2016. MJ Biz foresaw a much smaller market of $25 million to $35 million in medical sales. We think the ArcView/New Frontier figure is closer to the truth. There are currently 49 dispensaries operating in Nevada—a solid data point, because dispensaries are required to have a state license. Applying the Arizona model average of $2.6 million in annual sales per dispensary, that’s $127.4 million in total annual sales. Patient counts are less reliable in Nevada because an estimated two-thirds of Nevada dispensary patients are out-of-state visitors, who take advantage of the state’s reciprocity law. There are 25,291 active registered Nevada resident patients, which would yield a $67 million market. But if 2/3 of sales are to out-of-staters, that bumps the total market to $201 million in annual sales. In the end, we’ll go with the market estimate based on the number of licensed dispensaries. That’s a $127 million market, which yields 2,295 full time jobs.

Massachusetts: 1,283

With adult-use retail stores scheduled to open in July 2018, Massachusetts reported a robust MMJ market of 33,079 patients in 2016. The state labels 27,000 of those as “unique active patients served” so we’ll go with that more conservative figure as the basis of our total market estimate. That gives us an annual sales figure of $71 million. How accurate is that? Here’s a secondary basis check. The Massachusetts Executive Office of Health and Human Services (EOHHS) tracks the amount of cannabis flower sold monthly and posts it on a public dashboard. From February to November of 2016, the state tripled the amount of monthly flower sold and the number of patients seen at registered dispensaries. The market has grown so fast that just adding up the 2016 numbers doesn’t give us an accurate picture of the market today. If we extrapolate the November 2016 numbers—which the trendline indicates will only continue to increase—over 12 months, we see 16,000 ounces sold per month. At $350 an ounce, that amounts to total sales of $67.2 million, which is close to our $71 million estimate. A $71 million market supports 1,283 full time jobs.

Illinois: 954

Illinois expects to record $35 million in medical cannabis sales in 2016, but that’s a figure dragged down by extremely low patient counts, dispensaries, and sales in the first two quarters of the year. Illinois opened its first dispensaries in early 2016. By the end of the year, the state recorded $4.4 million in monthly sales. If we extrapolate that November sales figure to twelve months, we get a snapshot of a $53 million—and rapidly growing—market. That supports 954 jobs.

New Mexico: 723

$40 million in 2016 medical cannabis sales—with 29 dispensaries offering medicine grown on 25 licensed farms—yields 723 full time jobs.

Connecticut: 632

The size of Connecticut’s market surprised us. The state currently has 14,821 registered medical cannabis patients who frequent eight dispensaries across the state. Four licensed producers grow the crop for the entire population. If we cut patient count by 10 percent—because we’re not sure how many of those registered patients are active purchasers—to 13,339, that yields annual sales of $35 million. Which is about $4.4 million per dispensary, or $367,000 per month. That’s a reasonable estimate. A $35 million market supports 632 full time jobs.

Montana: 629

With 13,190 patients and $2,643 per patient in annual sales, Montana sees an estimated $34.8 million in annual sales. MJ Biz estimated that 50 to 60 dispensaries operated before the Montana Supreme Court shut them down earlier this year. (That shutdown later became a start-back-up after the November passage of Initiative 182, which legalized dispensaries.) If each of those dispensaries did only $50,000 in business per month—that’s $1,667 per day, or about eight patients per day—that’s still a $30 million market. We’ll stick with the $34.8 million number, which yields 629 full time jobs.

New York State: 573

We expect enormous growth in New York’s medical cannabis system in 2017 due to the recent rule changes that allow nurse practitioners to certify patients and include chronic pain as a qualifying condition. Even under the previous rules, which were notoriously difficult, New York’s patient base grew from 481 in January 2016, to 11,989 one year later. If per-patient annual sales are $2,643, that’s a $31.7 million market. That yields 573 full time jobs.

Maine: 470

Maine’s $23.6 million in medical cannabis sales in 2015 supported 426 full time jobs. http://www.pressherald.com/2016/01/20/medical-marijuana-use-climbs-as-mainers-seek-pain-relief/ MJ Biz forecast $30 million to $35 million in sales during 2016, which would be an increase of 25-45 percent. That seems like a stretch for a medical market that was already mature (as compared to, say, New York’s). Let’s estimate that Maine saw a 10 percent increase in sales in 2016 due to interest drummed up by the state’s adult-use legalization campaign. That would result in a $26 million market, which yields 470 jobs.

Rhode Island: 439

Three state-licensed dispensaries brought in $1 million in sales tax during the 2016 fiscal year. Given the state sales tax rate of 7 percent, that amounts to $14.3 million in total annual sales. But the state health department had 13,216 patients registered in early 2016. There are probably many more by now. And 13,216 patients would spend, on average, a yearly total of $35 million. Clearly a lot of patients are bypassing the dispensaries to purchase from the state’s 3,200 or more licensed caregivers, who may grow for up to five patients each. We’ll estimate that only half of those caregivers do it for pay, so let’s call it a $10 million market there. A total market size of $24.3 million supports 439 full times jobs.

Maryland: 294

Maryland’s medical market isn’t yet open, but preliminary licenses were recently issued to 15 growers, 15 processors, and 102 dispensaries. (There is some overlap; a few have licenses in all three phases.) Final license approval and the first dispensary openings aren’t expected until later 2017 or possibly 2018, but with preliminary licenses in place, each of those licensees has executives and managers already working full time. At this early stage, we’ll keep our estimates extremely conservative: four jobs for each grower, two for each processor, and two for each dispensary. That gives us a total of 294 full time jobs.

New Jersey: 199

As tight as New Jersey’s MMJ regulations are, the state still saw $10 million in annual sales in 2015, which supported 181 full time jobs. We’ll estimate a 10 percent increase over 2015 for a 2016 market of $11 million. The new inclusion of PTSD as a qualifying condition in 2017 should continue to grow that market. $11 million in sales translates to 199 full time jobs.

Minnesota: 190

A strangely small market for a state with 5.5 million people, Minnesota has 3,649 active patients and eight licensed dispensaries, yielding an annual market value of $10.5 million, which supports 190 full time jobs.

Vermont: 143

An estimated 3,000 patients are served by four dispensaries and four cultivation sites. The addition of chronic pain to the state’s qualifying conditions in mid-2016 should increase that patient count. But it’s still a relatively small market. A $7.9 million market supports 143 full time jobs.

Delaware: 81

With 1,700 patients, $4.5 million in annual sales, and just a single dispensary, Delaware’s medical market supports 81 full time jobs.

Florida: 70

Florida’s new medical marijuana amendment, passed in November 2016, took effect Jan. 3, but the first dispensaries aren’t expected until early 2018. (The state doesn’t even have to issue the first patient cards until Sept. 3, 2017.) That leaves the state with seven licensed nurseries legally growing and selling low-THC, high-CBD cannabis to a very limited number of patients. We don’t have any data beyond those seven licenses. Estimated number of full-time jobs: 70.

New Hampshire: 52

There’s not much data at all coming out of the Granite State. Four licensed dispensaries serve around 1,100 patients for a market of about $2.9 million. That supports 52 full time jobs.

Hawaii: 48

Hawaii has a robust patient population—the state counts 14,492 registered cardholders in a state of 1.4 million—but no dispensaries ready to serve them yet. The first 16 licensed dispensaries were supposed to open back in July 2016, but patients are still waiting. For now they have to grow their own or obtain it from a caregiver. When those 14,492 patients can patronize dispensaries, they may create a market worth $38 million in annual sales. Until then, we’ve got to keep our full-time job estimate extremely low as dispensaries and growers remain in the preparation phase. Between 16 dispensaries and the growers getting ready, let’s say those make up 48 full time jobs right now. Normally we’d add some caregivers to that job total, but Hawaii law allows each caregiver to grow for only one patient, so basically all of those 14,492 patients are growing their own or obtaining from a caregiver who’s not allowed to supply enough patients to turn the garden into a paying job.

Pennsylvania – Not open yet. License applications will be accepted in 2017, and the first dispensaries are expected in mid-2018.

Ohio – Not open yet. Final regulations are expected in September 2017, with the first of 40 dispensaries expected to open by Sept. 2018.

Louisiana – Not open yet. And not likely to open anytime soon. The medical marijuana law passed in 2016 allows for 10 licensed “medical marijuana pharmacies.” But pharmacists are, under federal law, licensed by the DEA—and the DEA will not allow any pharmacist to legally dispense a Schedule I drug. How lawmakers in Baton Rouge will ultimately solve this conundrum is anybody’s guess.

North Dakota – Not open yet. Dispensaries are not expected to open until at least 2018.

Arkansas – Not open yet. The state must begin accepting applications for dispensaries (at least 20 will be licensed, but no more than 40 total) by June 1, 2017.

Totals:

If we tally up the full-time jobs supported by the cannabis industry (both medical and adult use) in the nation’s legal medical and adult use markets, we reach a total of 122,814 full time jobs.